Will you Collect on Your Civil Court Money Judgment?

Collectability Assessment answers this question: Will I get paid if I win my case?

You won after years of battling in civil court, a few days in Arbitration, or an hour in Small Claims Court. You sit in your easy chair happy it’s finally over and study the piece of paper you received. It’s called a Money Judgment. It says you are the prevailing party, hmmm, that sounds good, and quantifies the amount to which you are entitled. Yup, this looks good. You ask yourself, I wonder when I’ll get it?

This person, Easy Chair Harry, is in for a life lesson. The answer to his question is you will most likely not get it until you chase down the assets of your adversary who is now your Debtor. All you really have now is a piece of paper saying you won. If you do not have an opponent willing to pay up voluntarily with their assets or insurance proceeds, you have another nerve-racking, time-consuming job ahead.

🍪 Smart Cookie Tip: Collecting on your judgment can sometimes be more difficult than obtaining the judgment.

Because of this stark reality, you need to take a very important step we call Collectability Assessment before you file your action. Carefully assess the probability of collecting on the judgment you will invest your valuable time and resources obtaining. Otherwise, your judgment could be just an expensive piece of paper to remind you not to do this again unless you have a ‘juicy’ defendant.

Locating Assets to Pay your Civil Court Money Judgment

The first step after Naming and Locating Defendants is to locate your adversary’s assets. Collectability Coach delves into the specific steps to identify your adversary’s assets and liabilities, including:

-

- Real estate owned

- Businesses owned

- Employment status

- Professional license status

- DMV license status

- Bankruptcy information

- Divorce Information

- Other judgments against them

Assessing Collectability

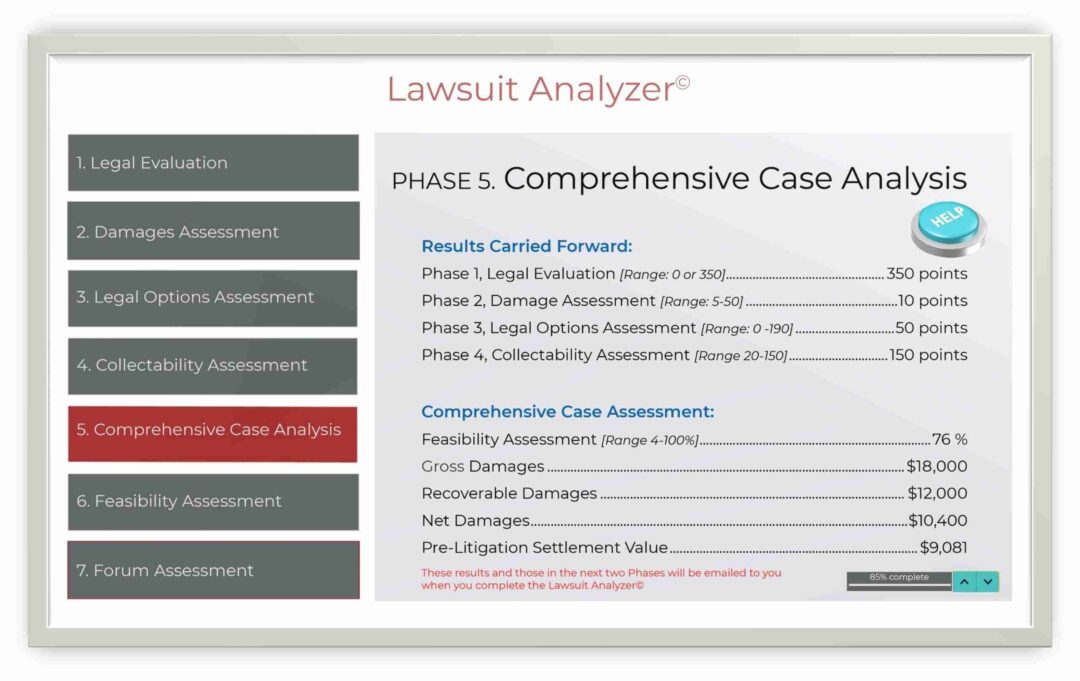

Phase 4 of Lawsuit Analyzer© performs a Collectability Assessment based on your research of your foe’s financial standing by asking you to choose from an extensive list described in Collectability Coach. That ranking then is utilized in Phase 5 of Lawsuit Analyzer© to provide a Case Feasibility Analysis depicted in the chart below.

THE BACK STORY

This chart, Comprehensive Case Analysis, is beyond the scope of Collection Assessment, but is provided so you can see the impact collection status in Phase 4 has on overall case feasibility.

Phase 1, Legal Evaluation is 350 points as legal liability tests in Phase 1 are met.

Phase 2, Damages Assessment is only 5 points out of 50 since estimated Net Damages are above the Small Claims Court limit, and the complaining party did not elect to decrease case value to fit the limit which would have earned him 50 points. If not a Small Claims case, points are earned based on Net Damages which in this case are $8,600, earning him 5 points.

Phase 3, Legal Options Assessment is 0 out of 150 points due to many factors:

- $11,500 estimated Recoverable Damages are higher than the Small Claims Court limit of $8,000 in his state and giving up $3,500 to come under the limit was not acceptable to this claimant (at least not yet).

- There is no written contract between he and his adversary providing for attorney fees to the winning party so he will be out legal fees paid or give up a high percentage of his recovery on contingent fee.

- There is no written contract between he and his adversary designating Mediation-Arbitration as their forum, leaving him to battle it out in the complex upper courts (we refer to as the House of Horrors).

Phase 4, Collectability Assessment of 120 out of 150 points is quite good, earned because his adversary is a salaried employee (discovered by following the tips at Collectability Coach). This good ranking will increase overall feasibility which is needed since Phases 2 and 3 results are very low.

We explore Comprehensive Case Assessment, the lower portion of Phase 5’s Comprehensive Case Analysis, in other resource pages. While the program factors collectability into overall case analysis, you should now focus more intently on your own results to determine the pivotal question,

Based on Collectability alone, should I pursue this case?

You don’t want to be Easy Chair Harry who will now frame the judgment he will never collect on as a reminder of what not to do.

Collecting on Your Civil Court Money Judgment

If you filed an action after performing your Collectability Assessment, hopefully you now have a money judgment in hand, not like Easy Chair Harry but like High-Tech Harry.

If your judgment is not paid in the time allotted, often 30 days, there are steps for you to follow to Enforce your Judgment detailed in Collectability Coach. In lay terms, this means to go digging for assets. Most states have methods set up and a specific form to complete to help you do this, but it doesn’t happen automatically. You need to be aware of the steps and take them.

Plaintiff Becomes Judgment Creditor

Defendant Becomes Judgment Debtor

Most courts allow the plaintiff who has now taken on the status of a creditor to orally question the defendant, who now becomes the debtor, in a formal proceeding called a Judgment Debtor Examination where asset information is obtained directly from the lips of your debtor. It’s humiliating for them and quite invasive, but it is what happens when one becomes a debtor in the court system.

???? Smart Cookie Tip: If your debtor is licensed and the judgment you obtain relates to an act involving their license, you can often post the judgment on their license which requires payoff before their license can be used again. There are more collection procedures than you can dream of. But they all require very specific steps.

You can ask just about anything related to the debtor’s finances and assets, including account numbers. You can also subpoena the debtor’s paycheck stubs, bank records, deeds for any property they own, and similar documents that prove the existence and value of the debtor’s property.

A money Judgment as a Good Investment

Your Judgment bears the post-judgment interest rate in your state until paid – in some states as high as 10% per year. High interest is an inducement for the losing party to pay your judgment as soon as possible – or for you to sit back and wait as long as possible to be paid on your new investment with a 10% annual rate of return if that is the case!

🍪 Smart Cookie Tip: Patience can pay off. If your adversary is likely at some point to have enough money to pay your judgment and its interest, your judgment can become a good investment.

The truth is, if your Debtor is a juicy one, this could be the best investment you ever made.

Other internet resources related to this topic